The growth of Amazon EU was a gradual process, it took decades before Amazon became a household name throughout the continent. The tech giant’s expansion across Europe started with the United Kingdom and Germany in 1998. Since then, Amazon has expanded its influence further among neighboring European countries like France, Italy, and Spain. Such progress allowed Amazon sellers to make their brands known among European shoppers.

However, tax obligations in Europe have been costly and complicated for Amazon EU sellers. As a way of helping Amazon sellers manage their European tax, Amazon invites sellers to join VAT Services on Amazon.

This latest solution offered by Amazon will make your business expansion to Europe less complicated. With a fee of €33.30 per month, tax obligations in Europe will be filed via a third-party tax service provider.

What is VAT Services on Amazon?

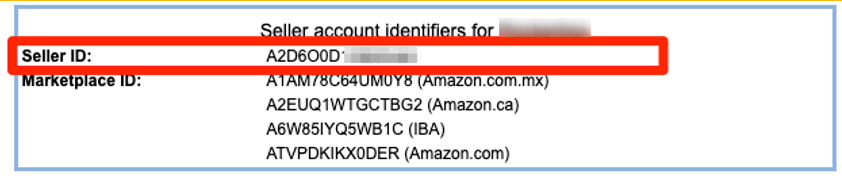

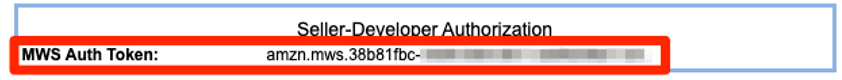

Amazon Seller University – UK: A screenshot (cropped) of VAT Services on Amazon; Retrieved Date: Sept. 14, 2021 from https://youtu.be/9ctlFU14bLs

VAT Services on Amazon is a VAT compliance solution that accommodates your VAT registration and filing obligations when you expand to the EU marketplaces.

The primary purpose of this Amazon solution is to help you deal with the European VAT landscape, particularly in the United Kingdom, Germany, France, Italy, Spain, Poland, and the Czech Republic.

Addressing Value Added Tax obligations in Europe can be confusing for sellers, especially since European VAT rates vary between countries and the type of products sold on the EU marketplaces.

Sellers can now deal with VAT compliance on the Amazon EU marketplaces efficiently and easily through VAT Services on Amazon. Amazon’s chosen third-party tax service provider will be the one to process VAT compliance for you.

Consequently, this VAT compliance solution offered by Amazon inevitably enables sellers to spend more time on other areas of concern when expanding across Amazon EU marketplaces.

What is Tax Representation?

If you are an Amazon seller not based in Europe, you will need to delegate Tax Representation to register for VAT in EU countries.

Simply put, tax representation is the process where someone acts on your behalf as a non-domestic seller in the EU. This tax representative can be an individual or a business that will help you with your tax obligations in Europe.

When you join VAT Services on Amazon, you can disregard the tedious process of searching, assessing, and later on, hiring a third-party tax service provider since VAT Services on Amazon has it covered.

Apart from covering the aforementioned processes, this latest Amazon solution also covers the expenses incurred for the first six months of filing and tax representation. Once the promotion period is over, you will be charged the annual fee.

Who is Eligible for VAT Services on Amazon?

When it comes to eligibility for the Amazon VAT service, the eCommerce giant stipulated that those with Amazon businesses based in an EU country are eligible to use VAT Services on Amazon without any constraints.

Furthermore, if your business is situated in a country outside of the European Union, such eligibility is limited only to the United Kingdom, Germany, and the Czech Republic.

It is also worth noting that VAT Services on Amazon do not support VAT registration or filings in the country where your business is based.

How do you Sign up for VAT Services on Amazon?

If you wish to Sign Up for VAT Services on Amazon, here is what you should do:

- Log into your Amazon Seller Central account. Once logged in, navigate to the Manage Your VAT section, under the Reports Tab.

- Once redirected, you will be given a selection of EU countries. After choosing, you will have to confirm your business details.

- Once company information has been confirmed, you can click on Agree and Continue button to enroll.

Why Should you Expand to Amazon EU?

If you are still hesitant to expand your Amazon business to Europe, here are some reasons why more and more Amazon sellers are branching out to Amazon EU marketplaces.

-

Sales Diversification

Expanding to Amazon EU marketplaces means more sales opportunities and revenue. Sales fluctuation on a single market can be avoided when you join Amazon EU since it has various marketplaces with different peak sales and holiday seasons.

-

Logistics Leverage

Similar to Amazon.com, Amazon EU marketplaces also offer sophisticated logistics and fulfillment services. This is especially true if you are an Amazon FBA seller.

-

Sales Expansion

Needless to say that expanding the European market means potential sales increase. Amazon UK and Germany are the best starting points for your expansion as they represent some of the largest eCommerce countries in Europe.

-

Growing International Market

The expansion of Amazon in Europe is far from being over. There are still other avenues for expansion which means more sales opportunities and growth. As Amazon EU marketplaces grow, so will your business.

Prepare Your Expansion

To help you with your pricing strategy, the use of an automatic AI repricer is recommended. An AI repricer can easily adjust your listing price to offer a competitive price across Amazon international marketplaces.