Seller Snap Podcasts

How to Use Amazon Business to Sell More Products

About This Webinar

Adrian Rich from Seller Snap joins hosts Dustin Kane & Kris Gramlich to dive deep into Amazons new program, Amazon Business. This dynamic program has been strategically designed to empower businesses by streamlining and modernizing the procurement process. Seamlessly integrated within the familiar Amazon experience, it offers a comprehensive suite of management controls and advanced analytic tools.

This webinar shines a light on Amazon’s proactive approach to position this program as a formidable contender within the B2B space, and how Seller Snaps innovative repricing and analytics platform can be harnessed by sellers to finely tune their business strategies. Seller Snap shares the initial results garnered from clients who have embraced these seller tools, highlighting significant increase in sales volume coupled with an impressive elevation in buy-box performance.

Overview

- [00:00:06] - Introduction to the episode and guest, Adrian Rich

- [00:01:03] - Adrian Rich introduces himself and Sellersnap

- [00:03:31] - Explanation of Amazon's strategy for Amazon Business

- [00:04:28] - Amazon Business offers can be shown to non-business customers

- [00:05:08] - How to determine if a product is eligible for Amazon Business

- [00:06:34] - Benefits of selling to business customers on Amazon

- [00:07:43] - Sellersnap's decision to create a tool for Amazon Business

- [00:09:29] - Setting attractive business discounts

- [00:10:34] - Using Sellersnap to outsell competitors on Amazon Business

- [00:12:52] - This is just a small window in time where we have been beta testers for Amazon's new technology.

- [00:13:34] - The repricing industry for B2C is mature, but the B2B side is still developing.

- [00:14:34] - We have been in beta with our tool for a year, waiting for Amazon to make changes to allow us to release it.

- [00:15:28] - We can reprice as regularly as once every two minutes for the B2B side.

- [00:16:17] - The advantage comes from B2C sellers not being able to respond quickly to B2B offers.

- [00:17:50] - We offer quantity discounts only if another competitor is offering them.

- [00:18:59] - The buy box for B2B offers is more dynamic and changes based on quantity and price.

- [00:20:00] - B2B sellers have the opportunity to be alone in the buy box, without many competitors.

- [00:23:22] - The growth for our clients has been in volume of sales, not profit per unit.

- [00:24:40] - The difference between a rule-based repricer and an AI repricer.

- [00:24:32] - Adrian Rich discusses the next step in the Amazon business space.

- [00:24:40] - Chris asks Adrian about the difference between rule-based repricers and AI repricers.

- [00:24:48] - Adrian explains how Sellersnap uses a game theory-inspired approach to repricing.

- [00:25:28] - Adrian discusses the limitations of rule-based repricers and the benefits of algorithmic repricers.

- [00:26:32] - Dustin asks if Sellersnap takes into account inventory levels of competitors.

- [00:26:58] - Adrian explains that Sellersnap doesn't have access to competitor inventory information.

- [00:27:42] - Dustin and Adrian discuss how some tools estimate competitor inventory levels.

- [00:29:00] - Dustin asks Adrian about the percentage of multi-quantity orders on Sellersnap.

- [00:29:40] - Adrian explains that many business sellers on Sellersnap sell single units.

- [00:30:12] - Adrian and Dustin discuss the potential for Amazon to offer fee discounts for quantity sales.

- [00:30:58] - Adrian mentions the upcoming SP API developer summit and the release of Amazon's roadmap.

- [00:31:11] - Adrian talks about the benefits of the new business APIs and the additional data they provide.

- [00:31:44] - Adrian explains how the new sales traffic reports help determine buy box share.

- [00:33:07] - Dustin asks about winning the buy box for localized offers with low inventory.

- [00:33:23] - Adrian confirms that low inventory offers may not win the buy box for customers in different regions.

- [00:34:10] - Adrian mentions the new order online, pick up in store tool and its localized offers.

- [00:34:39] - Dustin invites listeners to visit sellersnap.com for more information and a 15-day free trial.

- [00:35:45] - Adrian expresses interest in receiving feedback from customers and hints at future developments.

- [00:35:57] - Dustin thanks Adrian for joining and wishes everyone a happy Prime Day.

Transcript

Dustin

[00:00:06]What's up, everyone? And welcome to episode 273 of two Amazon sellers and a microphone brought to you by Solozo today. I think this is going to be a fascinating conversation. A lot of sellers out there may not know about Amazon business and that you can sell direct to businesses, offer discounts for quantities, all these other unique programs that Amazon's rolled out, and we're going to be talking about that and a whole lot more with Adrian Rich. He's the head of product at Sellersnap.

Dustin

[00:00:41]How are you, Adrian?

Adrian Rich

[00:00:43]I'm good, Dustin. I'm good, Chris. Thanks for having me on the show. Excited to be here.

Dustin

[00:00:47]Yeah, we're excited to have you, too. I want to start just by introducing you and Sellersnap. So I'd love to give you the floor here just to talk a little bit about your background, how you ended up with Sellersnap and what Sellersnap really is.

Adrian Rich

[00:01:03]Yeah, 100%. So happy to share a little bit about me and the technology and Sellersnap. So, as you know, Adrian, I'm the product lead here at Sellersnap. I came on board a few years ago and I've really spent a lot of my time with the technology. The third party integrator for Amazon, building out solutions to support third party sellers, specifically on Amazon, improve their results. I guess that's sort of the end result is to improve how their businesses are performing.

Adrian Rich

[00:01:33]And Sellersnap as itself is a repricing and analytics platform. We sort of use a game theory inspired approach to making sure that those that have competitive listings, that is asins that you are competing against other sellers, win the buy box at the highest possible price and for the longest amount of time. And there's just been some really interesting updates and changes in the industry this year, and it's been a long time coming for the last two years to this point. And so I'm keen to talk through that with you guys today and just share some of the industry knowledge that we've accumulated over the last couple of years, over the last six years since the company was incepted, and share that and just discuss what those impacts are on the industry and so forth.

Kris

[00:02:18]Yeah, I've been seeing a lot of seller snap ads and stuff around social media, so I'm getting more familiar with you guys. But today's topic, Amazon business. What is Amazon business and how is it different than just regular Amazon? I don't even know if many people know what even Amazon business even hits.

Adrian Rich

[00:02:38]Yeah, it's a good question, and I think the only way to really explain is to understand a bit about Amazon's strategy, their growth strategy for 2023, which is closed door type decisions that we're not privy to, but we're enough in the space that we understand a bit about what they're trying to achieve through some of the stuff we hear at Amazon accelerate or any of those other types of conferences.

Adrian Rich

[00:03:02]And there's a clear decision to push this Amazon business program, which is essentially them trying to open up Amazon to business customers. It's b to b purchases, and not just b, two b purchases, but also quantity purchases. So they clearly want to become a real significant player in the business space. They want businesses of all sizes to choose. Amazon is the first place to buy in quantity and to buy in bulk.

Adrian Rich

[00:03:31]And they're releasing a handful of programs and pilots as well as a handful of new technology on sort of the SP API side of things to match these decisions to grow the business side of the b to b side of the business.

Kris

[00:03:46]So Amazon business is where businesses can go sign up for a business account and they can give bulk discounts for buying multiple items at one time.

Adrian Rich

[00:03:59]That's exactly it. And even just a price for being a business customer to buy one unit. So anyone that has a business Amazon account may see a cheaper price for a good just because they have a business account, which is interesting. But the real crux of it for sellers is that this is just not as of a competitive space yet. There's a maturity around the B to C Amazon, but there isn't the same maturity around the b to b side of things. And that's where the opportunity exists.

Kris

[00:04:28]Now, can sellers pick and choose which items they want to be eligible for Amazon business, or does it take your whole catalog and make it an Amazon business listing?

Adrian Rich

[00:04:40]That's actually a really good question. It's an interesting one, because on certain scenarios, Amazon, when there is not a business offer available, will offer a b to c offer to a business customer. So they don't want a scenario where there isn't a b to b offer. And so if the best price good is a b to c offer, they will provide that to the business customer. So essentially, whether you were choosing to offer business discounts, business quantities or not, you may still be selected for a business offer.

Adrian Rich

[00:05:08]It's just how you use that knowledge to improve your results.

Kris

[00:05:12]Yeah, and I've noticed this on my own account where I'll start getting some orders and it'll say business customer below their name. I'm not really sure where it's at, but it's in the order id somewhere it'll say business customer. So that just shows that somebody is actually using this Amazon business. They're going to Amazon business. They're typing it in. I don't have any business offers, but Amazon is still showing my products to.

Adrian Rich

[00:05:39]Those business, you know, whatever analytics tool you're using, if they are set up to look at business sales, you can actually see what proportion of your business is selling to business customers. And I think that's interesting because that might make decisions on how do you decide to replenish or restock. Is a business customer sort of the direction you want to grow your business in? Do I want to look at things that are bought in quantities rather than in singularity?

Adrian Rich

[00:06:04]And so there's some strategy around that as well, both from the repricing side, but also from the business operations side of things.

Kris

[00:06:15]Dustin, you with us? I think we lost Dustin. I think we lost Dustin just a.

Adrian Rich

[00:06:24]Few moments behind us.

Kris

[00:06:25]Yeah. Can you guys. There we go.

Adrian Rich

[00:06:27]Now we got you. Now we got you.

Dustin

[00:06:29]I don't know what happens. It kept cutting out on me, so I apologize.

Kris

[00:06:33]No worries.

Dustin

[00:06:34]So from the business customer standpoint, when they're searching through their business account, they're seeing offers that a typical Amazon shopper does not see. Is that correct? There's more.

Adrian Rich

[00:06:48]Yeah. So not only are they seeing offers that a, b to c customer can't see, they're actually seeing a buy box that a, b to C customer won't see. So the way we sort of looking, we're looking at it at the moment is that there is a secondary buy box on the Amazon UI, on the Amazon storefront and only certain customers see that. But it just means that that's a new buy box that you can strategically try to attack and price adjust in order to obtain it.

Kris

[00:07:19]Adrian, why go after Amazon business? What was the reasoning Sellersnap decided to create this tool? Are you guys seeing potential growth with Amazon business? Is it something that blue Ocean. Not a lot of people are playing with because I haven't heard about this honestly in a long time. But is this a scenario that Amazon is putting more focus on? What are you guys seeing?

Adrian Rich

[00:07:43]Yeah, that's a good question. It definitely is blue Ocean, but it's not something that people weren't dabbling in. Sellers were there trying to get a head start in an extra market or an extra niche using Amazon business for years now. And we had a tool that provided solutions for this. The problem was it's the Wild west, the way that most price changing technologies work and all Amazon solutions really is through the tangible information that you get through their API.

Adrian Rich

[00:08:16]And until the last couple of years, Amazon wasn't making the business information available to third party integrators like ourselves or to customers. So you could make an offer for business, but you didn't know what anyone else was doing. You might have an offer for $10 and another seller is at $12 and another seller is at 980, but you don't know if you're being competitive. And so you're just the Wild west making decisions, not knowing how that's going to impact the competitive landscape or the competitive environment. And so the major changes Amazon made was they made all this information available to sellers and third party integrators so that we can make actual educated decisions on how we should price change in order to compete. And that's both for the business buy box, but also for quantity tiers.

Kris

[00:09:04]Gotcha. Did we lose Dustin again?

Adrian Rich

[00:09:10]Okay, I think it's just you and me, Chris. We're just going back and forth.

Kris

[00:09:16]If sellers want to get the business discounts, is there a certain percentage they have to take off of the regular Amazon offer to make the business discount attractive?

Adrian Rich

[00:09:29]Yeah, good question. So we're making it attractive that I can't comment on. I don't know what the customer perceives as an attractive offer, but in order for Amazon to accept it as a business offer, it has to be equal in price or below the b to C offer. So that can be by a cent that it just has to be equal to or below. Because as we said before, Amazon will promote a b to C offer as a b to B offer.

Adrian Rich

[00:09:54]And so they will also accept a b, two B offer that is equal to your b to C. But we generally say that you need to be a cent below in order to obtain it. Okay.

Kris

[00:09:54]You mentioned earlier that this is a tool for those that have a competitive buy box, meaning that this is for people that are in wholesaling or there's multiple sellers on the buy box. Okay, so if I wanted to take advantage and outsell the other sellers on the listing, how would I get started with using Sellersnap? And what would I need to do to start selling more? I want to sell more product using your.

Adrian Rich

[00:10:34]So even before I think we get into how the sellers snap solution of, I just want to take a step back and talk once again and just a bit more in depth about what Amazon rolled of this wild west thing that I spoke about before. Because previously it was possible to set business discounts through Sellersnap. Or any other repricing solution, or to manually go into seller central and set these business discounts or these quantity discounts and tiers.

Adrian Rich

[00:11:06]And so with this additional information, I don't want to get overly technical today, but it's referred to as an AOCN, an any offer price change notification, which occurs anytime there is a change in a price in a listing, a change in a featured offer, that's the buy box or a seller enters or exits a listing. And so this has been a technology that, it's called a notification is a technology that Amazon has provided to sellers and third party integrators since early on in the API's development.

Adrian Rich

[00:11:38]And now that's available for the b to B side of the business as well. For the business side of the business. But because it's such new technology, and until only a few weeks ago, was this sort of available to the public in a usable fashion, there isn't any sort of technology out there that can support it. So essentially what's happening is anyone that can actively reprice their business offers can have a real head start on the competition, because no one's able to actively compete without manually changing prices really in seller central or only responding to their ideas of what they think the business price should be, not what it should actually be, in order to compete competitively.

Adrian Rich

[00:12:24]And so to bring back to the question initially, really all seller needs to do, if they're accelerap customer or interested in trialing it is enable this tool. And our algorithm just determines, because of this newly available Amazon data, where you should be priced in order to compete. And what we're seeing is that people that are using the technology are getting 100% of the buy box because no one can actively compete at such a new technology.

Adrian Rich

[00:12:52]And this won't last. Like, we're very aware that this is just this small window in time where we happen to have been a beta tester for the technology and giving feedback to Amazon for the last two years. So we were really ready. But this will change. At the moment, it's just you can take the guesswork out of setting quantity discounts and get a head start in your competition for really the first time in Amazon business.

Kris

[00:13:16]So if I understand what I'm hearing, you were the first to market on this new technology and you're seeing your customers are winning the buy box more often because they're using a better repricer than the normal repricers out there that are just making changes in seller central.

Adrian Rich

[00:13:34]Yeah, it's more than that. The repricing industry for b to C is really, I don't know, what's the word? It's mature. Everyone's using a repricer, and the repricers are as quick as they can get, and they're kind of commodity products. Everyone has one. Some use AI, some use game theory, some are rule based, but they're like, pow, pow, pow, pow, pow. They're moving really quickly, but that's not possible yet with the b two b side of things because no one has the technology or the tooling.

Adrian Rich

[00:14:06]We were just fortunate to work in a feedback loop with Amazon on this for a two year period. We started in May 2021, giving them feedback, and we had developed a tool, and we've been in beta with it for a year, but we couldn't release it at scale because we were just waiting on Amazon to make a couple of changes that allowed us to release it. So we've done months of back testing on this tech, ready to go with a handful of sellers, and the results are quite remarkable.

Adrian Rich

[00:14:34]But they're temporary because everyone will start to, the industry will become as mature as the b to C side, and you'll start to see that more competition and more active price changes, which leads to just stabilizations in those business offers.

Kris

[00:14:49]How often are you making price changes? Is this happening like every 15 minutes? Is this a once a day price change? How often does the price change happen?

Adrian Rich

[00:14:58]Yeah, good question. So, on Amazon's API limits, often you can make a price change to about once every two minutes. We say 30 times an hour. So we can reprice as regularly as that for the B two B side of things. We're not repricing as regularly as that because like I said, no one is actively responding. So we make a price change, and it might take a competitor 24, 48 hours to actually say, oops, there's been a price change time to lower the price.

Adrian Rich

[00:15:28]And so we're not price changing so often, but we can go as fast as once every two minutes just to.

Dustin

[00:15:35]Make sure I'm understanding it correctly. So if I'm selling a product, I'm assuming I can sell it b to c and b to B. So the repricer is actually changing both of those prices independently?

Adrian Rich

[00:15:51]Yeah. So you can imagine it like two different buy boxes. The only limitation is the b to B price has to be equal to or lower than the b to C price.

Dustin

[00:16:01]So where the advantage comes in is the b to c. Sellers can't respond to a B to B offer from the repricer quick enough. So that. That's why the B to B offer is sticking.

Adrian Rich

[00:16:17]Yeah, they can't respond. Well, the B to C offers only get put into place when they're sort of the best offer, but they're not responding to that. They're responding to the b to C offers. So they're not looking at the B two b buy box, and they're not saying, how should I reprice? The second thing is that if they are setting a singular b two b price, then they're not able to respond fast enough because they're not receiving that information in a timely fashion that permits them to make those real time decisions.

Dustin

[00:16:47]Interesting. So what is involved in the price changes? Because you mentioned quantity discounts. So as a business seller, do you just give it tiers?

Adrian Rich

[00:17:03]No, I'm with you. I've got you. I got the question. Do you just give it tears? So the way the tool is currently working, I think we've lost them now, but I'll keep answering the question.

Dustin

[00:17:14]I apologize.

Adrian Rich

[00:17:15]No, you're good. I got the whole question, Dustin. So I'll answer anyway. So the way the system works at the moment is it's only actively competing against customers. So in our headspace, our logic here, and we plan to give some more flexibility. But really, you want to win the buy box at the highest possible price. That's obvious. You're not offering discounts for no reason. Amazon's taking a fixed fee no matter how many units you sell. So why would you offer a discounted rate for buying ten unless you're trying to liquidate. Right.

Adrian Rich

[00:17:50]Like, fairly simple logic. So what we're doing is we won't offer a business discount unless someone else is offering. Sorry. We'll always offer a business price, but we won't offer a quantity tier and quantity discount unless another competitor is offering one. But then we'll match them all along the way. So, before I spoke about the Wild west, everyone's doing different things for a business offer. $10, $12, $8, et cetera. The same thing's happening with quantity peers.

Adrian Rich

[00:18:18]There's two sellers, Chris and Dustin, and one's offering units at 2468 and ten, and then Dustin's offering units at 1020, 30, 40, and 50. And so before, that's just what you offered. And Amazon will determine what is the best price. But now we can see those offers. So you set them. We receive them as a notification. We go, well, what's the best price to be at for all of those tiers? And then we actively compete to be better than them. Just by a marginal amount.

Adrian Rich

[00:18:48]But because people can't price change as quickly as we can, then we're seeing significant percentage of buy box share across all of those quantity tiers as well.

Dustin

[00:18:59]How does this look from the business buyer standpoint when they're looking at it? When they're looking at the buy box, do they see these tier quantity tiers in the buy box?

Adrian Rich

[00:19:11]Yes. So you don't, you'll be familiar with what the buy box looks like on Amazon, I guess. This is also a prime day session. So we've all spent some time on Amazon today and had a look for a good present or something that we need or something that we don't. And you'll see there's the drop down menu when you can choose 12345, and that's on the regular b to C landing page as well as the b to b. The difference is when you select the quantity offers for the business side, the page will actually refresh and you might be buying from a different seller depending on who's winning. So someone might be winning between one and two or one and four, and then someone else is winning between four and ten, and then someone else is winning between ten and 50, and then Amazon's winning after that because no one else has the inventory.

Adrian Rich

[00:20:00]And so every time you choose a different quantity, you might be presented with a different offer, depending on who has the quantity, who's got the best price, what their fulfillment method is, et cetera. So it's a completely new and just wild buy box. It's a bit more dynamic than we're familiar with.

Dustin

[00:20:15]So interesting. Now, I can see now where all this opportunity comes from for sellers who are opening up that business option. I mean, you could be alone in the buy box when normally you'd have 1015 competitors.

Adrian Rich

[00:20:31]Yeah, nearly 100% of the time at the moment for a lot of listings. And there's scenarios that we haven't encountered for, because it's just a new algorithm and we're learning. And this involves what you refer to as a lot of back testing. You sort of make repricing decisions and you watch how competition responds to it. And that's a time consuming process. You're just rolling out new AI type technology.

Adrian Rich

[00:20:54]But it is just a really interesting time. And I think that Amazon's really coming to play. And there's a lot of sort of pilot programs they've got going on where they're offering reduced fees for quantity discounts. And I can only see growth in this space over the next twelve to 24.

Dustin

[00:21:13]Speaking of growth, what is the size of the Amazon business portion and what is its growth rate right now?

Adrian Rich

[00:21:21]It's a good question. Let me pull up, we have a bunch of this statistics on our landing page, but there is a lot of growth in the space. I think they're calling 150,000 sellers and 10 billion in annual sales. So it's not small, but clearly they think this is just the tip of the iceberg.

Dustin

[00:21:40]But 150,000 sellers is small right now. That's why there's that opportunity compared to the amount of sellers going b to.

Adrian Rich

[00:21:49]C. Yeah, and I don't know, this is just direct from an Amazon report, sort of like their market health report on the Amazon business side. But it is a lot of opportunity. And I don't know how if they've inflated the numbers or not because like I said, they take across the b to C offers and give them to a business customer. So who knows if that's included in the number or not included in the number. But it's a lot of cash and there's a lot of opportunities to go with it.

Dustin

[00:22:20]What are some early results from your clients that are involved in this program? I mean, I know you mentioned they're winning the buy box a lot more, but what is that resulting in the growth of their business?

Adrian Rich

[00:22:32]Yeah, we had our first customer who launched with the tool. They were our first beta or Alpha customer. They were giving us a lot of feedback early on when it couldn't be, to provide some context there on why it couldn't be scaled. That notification I keep talking about, they weren't sending that with the right information. So every time we received the notification, we would do an API call, but it was limited in how many we could do a day. So if you had a store with a thousand listings or a few thousand listings, we couldn't scale it. So they were using it for a long time, but they just were optimum in their size of store to work for this beta program or Alpha program anyway. We watched their store go 100% on business purchases in the year that they came on with us, and they're really pushing that side of the business now.

Dustin

[00:23:22]Is the growth more in the profit per unit that they're getting because of this or the volume of sales?

Adrian Rich

[00:23:31]This was volume. This was volume. So they could just move stock so much faster because there was a whole side of Amazon that they were competing against that others weren't, which was good for their business. I think anyone would shy away from that. But it was fun to see. And I remember the first time I asked for the feedback because we test on an algorithm level, is the tool doing what it's meant to do, but we're not testing on a sales perspective. Is this having an effect on my business?

Adrian Rich

[00:24:05]So we then periodically ask, what effect is this having in a business? And we relay that type of information to Amazon when we're going through these roundabout sort of feedback sessions and to sort of get that screenshot when someone looks at their Amazon account on their phone with the yellow bars of the progress over a year, and just to see 100% over a year and that tagline and the subject for the email, we were like, oh, this is legit.

Adrian Rich

[00:24:32]So it was kind of like a glass shattering moment that this is a next step in the Amazon business space.

Kris

[00:24:40]Adrian, what is the difference between a rule based repricer and an AI repricer?

Adrian Rich

[00:24:48]Totally. So I guess this relates to the business side of things. But, you know, let's go back to our roots in selling, and this is sort of where Sellersnap built its niche initially. So the way we sort of talk about Sellersnap is the sort of repricing technology that doesn't need really heavy manual configuration by focusing on what we call a game theory inspired approach. So what you traditionally see in the space is a seller offers a good and a competitor comes in and undercuts their price.

Adrian Rich

[00:25:28]And that might be because a rule based system or rule based repricing has said, I want to undercut the current buy box winner by $0.01. But as we know, what ends up happening is this price will one cent, one cent, one cent, one cent, one cent until both sellers are selling at break even or losing money and no one's happy. And so the way that sort of seller snap works and other algorithmic tools work is they attempt to recognize those price wars occurring, and then instead of engaging, they try to raise the price where possible.

Adrian Rich

[00:25:59]So if you sort of see that price war occurring, is it not better to jump back up to your max price and then have a micro price war up there? Because you know what your competitor is going to do. It's always making the same decision. Drop $0.01 below, drop $0.01 below. So you know the behavior, and if you can track that, you can raise price and manipulate it. And so that's sort of what the difference is between a rule based system and an algorithmic based system.

Dustin

[00:26:25]Is is it taking into account inventory levels of competitors?

Adrian Rich

[00:26:32]It's an unbelievable question, and it doesn't. The challenge there is that tools like us we operate as an approved third party developer. Amazon doesn't make that information available to us. So we always know, why don't you use know, why don't you give that a go? They've got all the inventory information and go, well, we're not allowed to, we're not allowed to scrape information. So we would if we could. We understand the value there.

Adrian Rich

[00:26:58]If my competitor has one or two units left, let them sell out and then raise price. But we're just not privy to the information to do it. And we would love to, but we hear it all the time.

Dustin

[00:27:09]Yeah, that's something I deal with. I sell wholesale arbitrage as well. So I'm very familiar with repricing, and that's something that I'm always looking at because it is going to be a race to the bottom. But if there's only a few units left, I'll let them fight that battle and pick up.

Adrian Rich

[00:27:29]Yeah. Justin, do you know how those tools like keeper and stuff, they work out how much inventory is left in a competitor? Has anyone shared this info? Because it's actually very clever and really simple, isn't it?

Dustin

[00:27:42]Where it's probably the old way back when Chris and I started to figure it out, you'd put like a hundred.

Adrian Rich

[00:27:47]In a cart and you just wait to see how many you can get.

Dustin

[00:27:51]And then work it down until you see how many is left. Is there a limitation to that? I mean, if somebody had 20,000 units, you couldn't put 20,000 in a cart, right?

Adrian Rich

[00:28:02]I'm not sure, but that's how they sort of do it. And so we just can't scrape like that, which is unfortunate because it would be such an unbelievable tool. But a cool little tidbit on that. And this is sort of like the OG version of doing that, but for 2.0 for Amazon business, is that because in the response from Amazon regarding that notification regarding all the offers of the business customers, you'll see how many units a customer is able to sell. The competitor is able to sell because they stop winning the buy box at a specific point. So it might be at $10 we can sell 20 units, but then at 30 units it goes up.

Adrian Rich

[00:28:44]And then you know that the reason it's going up is because that specific seller has run out of inventory. So I don't think Amazon meant to give us that information, but there's a bit of work that can be done there to work out how much inventory your competitor has now. And we'll look into that type of thing now.

Dustin

[00:29:00]It's so interesting since you rolled this out. I'm curious, now that you've got business sellers and you're repricing it, how many of these orders are actual multi quantity orders versus just a single unit?

Adrian Rich

[00:29:15]It's not so much. It's not as much as we would think. There's a lot of business sellers and that are selling single units and we're getting people coming out of the woodworks that only do business. They are strictly business sellers. They have offers for the b to C side, but they're not competing on purpose because they realize that they got in early and they know that not with us. They were doing this before this. They just realized that it was a non competitive space.

Adrian Rich

[00:29:40]So we're seeing lots of single unit purchases and we think that the challenge there for sellers is that because Amazon is not offering you fee discounts, you sell ten units, you're still paying $4.20 for an Amazon fee, an Fba fee. So what's the incentive to sell in multiple units? And if they change that, I think you'll see a lot of quantity discounts being offered at a higher rate and at lower values. But that's going to be on the onus of Amazon to make the change.

Dustin

[00:30:12]Are they looking at making that change? Have you heard anything?

Adrian Rich

[00:30:16]There's always rumors. I think Amazon space is full of rumors, but no, we don't know any of that at the moment. I'll be in two weeks in Seattle, actually. There's the SP API developer summit and that's where they release their sort of roadmap for the next twelve months, the technology they're trying to bring out. And obviously that matches really high level decisions on Amazon leadership regarding marketplace. So we might see and you can kind of deduce what they're trying to achieve based on the technology they're planning to release. So they don't tell us we want to do this, but they do give you data points and then you go, they must be trying to do this.

Adrian Rich

[00:30:58]And so that's what we're really looking in that conference for. What's the next big thing going to be in the next twelve months? What are we going to be developing?

Dustin

[00:31:05]What have been some new releases through SP API that have been beneficial?

Adrian Rich

[00:31:11]I think the business APIs were the big one, definitely the biggest, because they just open up everyone to a new market. But they're also giving just new data that wasn't previously available in our side of things as well. They've started to give some really cool sales traffic reports in the last little bit that tell you how many views your page got in relationship to how many views the whole asin got. And so you can deduce more accurate buy box share.

Adrian Rich

[00:31:44]When you have that information, you have a percentage which was never available. Everyone's estimating buy box share, including ourselves, based on sort of predictive technologies. But with this information we can start to get a much bigger picture. And we know from what we're hearing from Amazon and just everyone seems to know in the space, we always see a buy box or two buy box winners or three in certain scenarios, but we know there can be hundreds.

Adrian Rich

[00:32:10]If you're in a FMCG good, a fast moving, consumer good space like supermarkets. And it's highly localized, you're selling lettuce or a packed salad. This isn't crossing the country in a day. This is going out in your neighborhood. Well, that can be a buy box product. And more of those products are coming onto Amazon through, you know, their relationship with Whole Foods now and so forth. And so in those scenarios, there can be hundreds of buy box winners. And so the old solution of just telling you there's one, well, it's just not holding up and they're aware of it and they're starting to make this information more available to customers. So if you're in the wholesale space or retail arbitrage or online arbitrage, they're good signs that they're listening to what technology providers are asking for. And the reason technology providers are asking for them is because sellers are frustrated.

Dustin

[00:33:07]I've always wondered that, actually. I mean, if I have a limited quantities, if I've got one unit left of a product and it's in an FC in New York and someone's searching in California, even though I had the lowest price, my assumption is I'm not winning the buy box for that California shopper.

Adrian Rich

[00:33:23]No, you're most certainly not. Almost. Now, what do they call it? There's that new tool they brought out, 21. It was order online, pick up in store. Do you guys remember that? When they were really pushing it? And it just gives you the opportunity to go to a best buy and buy the tv and pick it up directly. You don't have to wait for the shipping or pay for the shipping. So once again, that's going to be a really localized offer. But if you're in that zip code, they're going to show you that offer.

Adrian Rich

[00:33:56]And so you're right, you're not winning it on the west coast if you're selling it low inventory on the east coast most likely not. But no one knows that. No one knew that. And now we're starting to get some breadcrumbs that this is the way they're moving in terms of technology.

Dustin

[00:34:10]Adrian, I know there's a lot of wholesale, there's a lot of arbitrage, retail arbitrage, people that listen to this podcast, and I'm sure this is fascinating because this is a new wrinkle, something that I'm an arbitrage seller and I wasn't aware of this. So it's been really fun to talk to you, and I know that people listening right now want to learn more, want to try out Sellersnap. What do they need to do to get more information and get started?

Kris

[00:34:39]Totally.

Adrian Rich

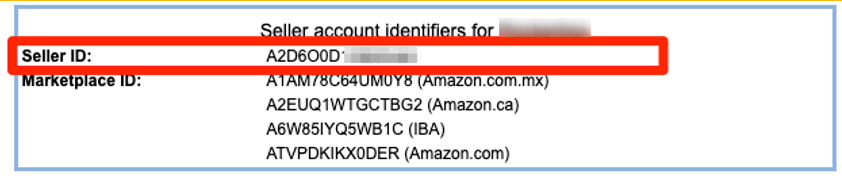

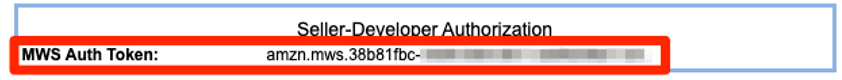

[00:34:40]So we offer a 15 day free trial. You just can create an account by going to our website that's sellersnap IO. I'm sure the link will be somewhere around here. There you go. There's the website. And you can just start a free trial. The team is really hands on, so we will get you on a call for a demo and set up everything on your behalf and go through strategy sessions. That's through the trial and then afterwards as well.

Adrian Rich

[00:35:07]And then we're just really interested in hearing feedback from customers on this one. It's a new tool for us, it's a new tool from the industry, and our tools come from the feedback we get from customers and the analysis we do on the data. So the more that use it, I think the better the algorithm is going to get. And then that's just an exciting thing for us and exciting things for sellers, too.

Dustin

[00:35:29]Well, Adrian, we appreciate the time. Thanks for joining us. I know I got a lot out of it. I know Chris did, too. I'm sure everyone that's listening, everyone should go visit sellersnap.com and we'll have you back on in the future because we want to see what you're rolling out next.

Adrian Rich

[00:35:45]Yeah, 100%. It was fun to be here, guys. First time on the show and on Prime Day. That's a bit of fun. And so, yeah, thanks, guys. Know, next time there's something to talk about. We love to have a chat.

Dustin

[00:35:57]Absolutely. Well, thanks, Adrian, and thanks, everybody for listening. And happy prime day to everybody out there. And we'll be back at this on the next.